Jessica's Newsletter

Q2 2025

Welcome to my newsletter where I give you an insider's take on real estate, with a special emphasis on where I sell — San Francisco. This morning, the August drizzle mixed with a bit of sun and fog and made a rainbow, always a good sign!

Once Upon a Time

The 2025 US economy has been pitted with uncertainty. In October 2024 the economy here was so strong that The Economist magazine declared it "the envy of the world." The Fed had begun to lower interest rates after two long years of aggressive rate hikes, seeing progress on inflation and a slight slowing of the labor market. The austerity had paid off, there was a sense of relief that we had dodged a recession... Finally.

Since the beginning of Trump's second term in late January, however, we've been hit with several anxiety-producing economic policies and their fallout — from DOGE to tariffs to the extremely costly "Big Beautiful Bill (BBB)." At times it has felt like our hard won economic footing is being chipped away.

Big, Beautiful, But...

In April, consumer confidence dropped to its lowest point since the height of the pandemic, and the global stock market had its largest decline since the 2020 stock market crash. And while the stock market has since hit record highs, inflation is now, again, a growing concern. The July jobs report showed the worst three-month stretch for job growth since the Great Recession, prompting Trump to fire the Bureau of Labor Statistics commissioner (not confidence inspiring!)

Durable goods inflation (autos, electronics, furniture, etc) over the last six months was the highest that it has been over any six-month period since the 1980s — outside of the pandemic. And by mid-2025 US economic growth had slowed to about 1.2%—roughly half the pace that economists projected in November 2024. Prices are going up. The Fed is holding firm on interest rates. Growth is slowing. It's a recipe for recession, or even worse, stagflation.

A New Golden Age?

But, then there's AI. Will it be our savior? Will it help offset the costs of tariffs and the BBB? Will it make us more productive, provide everyone a living wage, and create more work/life balance? Any conversation about the economy right now can't ignore the AI elephant in the room. And the room is in San Francisco.

AI hasn't fully made it into the economic data yet, but it's everywhere else. It's writing emails, recommendations and cover letters. It's doing customer service. It's helping college professors teach classes and students write papers. It's performing some entry level jobs. It's giving people personal and medical advice, and also making some go crazy. It's coding and making comp sci majors consider pivoting. It's serving up the most pertinent content while at the same time cannibalizing the content sources.

AI is the best librarian and the biggest pirate. It's one of the top reasons cited for the ~800,000 layoffs so far this year as companies restructure in anticipation of it, or respond to what it has usurped. It's paying its elite talent on par with Steph Curry. It promises to save trillions of dollars and to create new value in finance, manufacturing and healthcare. People love it or they hate it. One thing is certain: it's ushering in a new golden age in tech, and San Francisco is the hub.

San Francisco Rising

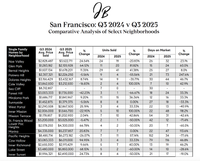

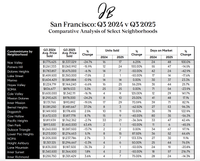

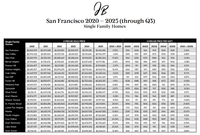

We're already experiencing AI mini shocks in our real estate market. In 2024 local companies raised nearly $35 billion in venture capital, fueling dozens of fast-scaling AI startups headquartered here. Major players, like SF's OpenAI and Anthropic, anchor the ecosystem, with talent clustering within blocks of their offices. The New York Times wrote a story this month crowning SF the capital of AI and describing our neighborhoods as teeming with young people. SF apartment rents have shot up 5.1 percent this year, the largest increase in the nation. SF MUNI, which operates the city’s buses, has also seen the most riders since the start of the pandemic.

I sold a rare, luxury $4.2M home in the Mission this April that was a six minute walk to Open AI's Mission offices, just a day or two after the first open house weekend. Of the 60+ offers received on my listings this year, many of the offerrers worked in AI, and most of those bidders made cash offers.

Unlike most Bay Area counties, SF’s housing market is strengthening, with fewer listings coming to market, fewer price reductions, and year-over-year home prices rising — more than anywhere else in the Bay Area. Luxury buyers appear to be entering early in what could be a multi-year growth cycle — before IPO-driven wealth truly spikes — as 2025 luxury sales here are up 19 percent year-over-year.

A Little Something for Everyone

We'll see what happens with the fall market. Consumer confidence just dipped again, companies are warning about the consequences of tariffs, and, for all its promise, AI is, for now, mainly costing companies money and unsettling the labor market. As crazy as it sounds, at this moment, it's a good time to both buy and to sell real estate here. Buyers have an opportunity to get into the market before the AI IPO frenzy. Sellers have the opportunity to come to a market with little competition and a pool of eager buyers looking to get in before the AI IPO frenzy.

Interest rates are still at 6-7 percent. And, as mortgage brokers like to say — you should marry the house, and date the rate (you can always refinance when rates go down...) Insurance companies are still being finicky about older roofs and knob and tube electrical systems, but there are ways to work through the challenges.

Another bright spot for San Francisco is our new mayor, Daniel Lurie. I like how he's always out on the streets talking with people and then taking action to solve problems. He signed legislation to enable the conversion of empty office buildings downtown into housing, he has streamlined permitting processes and cut red tape for retail pop-ups and small businesses, and he's helping boost confidence in downtown by ramping up public safety. So far, so good.

Giving Thanks & Giving Back

I've worked with so many repeat clients this year, and so many of you have recommended me to your friends and family — I am incredibly lucky and honored. Thank you. So far in 2025 I am among the top 5 overall agents in the city.

In my empty nesting, and out of a yearning to do more for the people here who need housing support, I joined the board of the Bernal Heights Housing Corporation. It's an organization that develops, preserves, and rehabilitates affordable homes throughout San Francisco. I'll be hosting a fundraiser for its sister non-profit the Bernal Heights Neighborhood Center in October, at my home—this community center is a lifeline for more than 2,000 SF seniors and youth, as city budget cuts are threatening the programs that serve them. If you would like to attend, donate or get involved, please reach out!

As always please don't hesitate to reply with any of your own questions or needs. I always look forward to hearing from you!

Have a wonderful end of summer,

Jessica

PS: For the record, I did not use ChatGPT to write this — I’ve been hooked on the em dash for years!